A complete description of the Not Impossible Plan is available below

To download The Not Impossible Plan in PDF form, click here

Also, a paper describing how the Not Impossible Plan could work in Canada is now available for download here. The Not Impossible Plan for Canada

The Not Impossible Plan

Update 1

Online Version

Author – Don Gayton, M. Eng.

Revision History

Original – October 30, 2015

Update 1 – July 15, 2018

Contents

1 Background

2 The Retirement Model

3 Some Unique Characteristics of Renewable Energy.

4 Introducing the National Renewable Energy Fund (NREF)

4.1 How the NREF can get us off fossil fuels by mid-century

4.2 The NREF in Operation

4.3 Other Supporting Policies Required

4.3.1 Mandate minimum percentage of low fossil carbon energy

4.3.2 Efficiency Standards

4.3.3 Policies not needed

4.4 NREF Advantages

4.5 A sample year – 2014

5 What Could Have Been

6 Conclusion

7 About the Author

1 Background

We humans release about 4.6 tonnes per person of fossil derived carbon dioxide (CO2) into the atmosphere every year as of 2015. Fossil CO2 is CO2 whose carbon atom comes directly from a fossil fuel, be it coal, oil or natural gas. The carbon in fossil fuel turns into fossil CO2 when it is combusted in air, releasing its stored chemical energy. This fossil CO2 has been the major driver behind climate change. CO2 is a well-known Green House Gas (GHG) that acts like the glass of a greenhouse, letting in visible light but blocking heat from escaping, thus raising the temperature below. The total amount of CO2 in the atmosphere has grown from 280 parts per million volume (ppmv) before the industrial revolution to more than 400 ppmv today, an increase of over 40%, and it is continuing to rise at a rapid rate as we continue to burn fossil fuels to allow us to live our modern lifestyle.

To prevent runaway climate change scientists calculate we must reduce humanity’s fossil CO2 emissions by 80% by mid-century and to zero, or even negative after that. Eighty percent reduction means less than 1 tonne of CO2 per person worldwide. This implies developed nations like the US and Canada need to reduce their emissions per capita to less than 2 tonnes per capita, a 90% reduction from the current level of more than 15 to 17 tonnes/year per capita. This extraordinary 8 times reduction required simply can’t be achieved through reductions in energy use by efficiency and conservation.

To achieve the necessary level of reduction while continuing to improve peoples’ lives worldwide we need large investments in renewable energy to provide the energy required to run our modern societies. With enough investment, it is technically possible to provide enough renewable energy in an ecologically sound manner to allow a good standard of living for everyone on earth with either minimal or no use of fossil fuels.

So far, many policies and schemes have been proposed and enacted to wean the world off fossil fuels, and all have been found lacking, either due to effectiveness or public acceptability, or both. Since the world community started to take Climate Change seriously about 30 years ago, annual fossil CO2 emissions have increased 63% from 22 B tonnes per year in 1988 to 36 B tonnes per year in 2015, and the total CO2 in the atmosphere has increased 14% over that same period from 352 ppmv to 401 ppmv and is now increasing at a rate of over 2 ppmv per year. In addition, investment in fossil carbon free renewable energy worldwide has flatlined since 2011, and has actual fallen since the Paris Accord was agreed to in 2015. While many people are taking individual actions, these will not be nearly enough. History has shown over and over again that only government action can achieve the kind of transformation required.

Given this reality, it is imperative that we come up with a policy or policies that do what appears to be impossible –

- A policy that drives investment into renewable energy to three times its current pace within 5 years and maintain that investment level for the next 4 decades.

- A policy that is acceptable to the majority of citizens, not just those who are passionate about climate change. Thus it cannot result in highly unpopular effects such as a large increase in the cost of energy, nor can it lead to a reduction in people’s quality of life or their freedom and it must be seen as fair, transparent and be easy to understand.

These policy requirements may seem impossible to fulfill, but I firmly believe these are necessary and unless they are met we will never achieve the 80% emission reduction required.

2 The Retirement Model

One way to think about the challenge of getting off fossil fuels is to think about “retiring” fossil fuels.

We work to provide money to live the life we want. At some point in the future we need to stop working and retire, but we will still need money. If we do nothing now, when it comes time to retire we will have very little money and will be forced to live an impoverished life. However, if we put some money aside now, and use that money to invest in means to provide income after we are retired, we can live a full, rich life after retirement without having to continue to work.

Similarly, we are using fossil fuels to provide the energy to live the life we want. At some point in the future we need to retire fossil fuels, but we will still need energy. If we do nothing now, when it comes time to retire fossil fuels we will have very little energy and will be forced to live an energy impoverished life. However, if we put some money aside now, and use that money to invest in renewable energy systems to provide energy after fossil fuels are retired, we can live a full, energy rich life without fossil fuels.

How much do we need to put aside now for a good post work retirement life? Financial planners agree that saving 10% of one’s earning is a good base. It turns out by coincidence that the same is true for energy systems. If we invest about 10% of what we spend on energy today to build renewable energy systems, by the time it comes to fully retire fossil fuels in 2060 we will have enough renewable energy to continue the way we live without any reduction in lifestyle.

This is a pretty outlandish claim – we pay an extra 10% for fossil energy now and by 2060 we have no more need for fossil fuels? This sounds impossible. However, it really can work.

3 Some Unique Characteristics of Renewable Energy.

Renewable energy projects, like the ones we need to retire fossil fuels, have unique characteristics that make them different from almost all other industrial projects.

1. The energy to be collected is free and inexhaustible. Be it wind, sun or heat from the earth, the energy that is collected by the renewable energy project has zero cost and is essentially infinite.

2. Renewable energy projects are very capital intensive. Almost the entire cost of the energy produced from renewable energy projects results from two factors; the cost to build the plant (capital), and the interest on that capital. In today’s low interest environment, both capital and interest play an approximately equal role in the final cost of produced energy, however that will change if interest rates rise.

3. Renewable energy projects have a long life and require little maintenance, For example, solar panels last for over 25 years and only require washing occasionally to get the dust and dirt off them. Wind turbines have somewhat higher maintenance costs, but are still low.

4. Renewable energy occurs in abundance throughout the world and in every country. Some countries have more solar resources, but every country has more than enough renewable energy potential to fulfill its own needs and countries that tend to have low solar resources (like England and Ireland) tend to have high wind resources.

5. Renewable energy requires nationwide coordination. Population trends, industrial development, energy usage forecasts, long range weather forecasts, electrical grid planning, pipeline planning, and many other factors all play into providing reliable, affordable, energy to a country.

A major factor in the long term success of renewable energy is finance – up until now renewables have generally been financed through conventional means designed for conventional projects. This means interest rates high enough and other terms favorable enough to attract institutional investors given the level of risk. Renewable energy projects must compete for financing with all other large industrial projects. Therefore, to attract lenders to renewable energy projects, governments have taken to providing subsides, like tax credits and loan guarantees. Even with these enticements and in our current low-interest rate environment in 2015, renewable energy projects typically have to pay interest rates in the range of 5% to 8% and even higher in developing countries. In Al Gore’s movie An Inconvenient Sequel: Truth to Power, Mr. Gore informs the viewer that India’s interest rates of 13% for solar projects are causing them to balk at supporting the Paris Climate agreement. At 8%, interest is responsible for about ½ of the total cost of producing renewable energy. In other words, over a 20 year term, half the total money expended is used to build the project, the other half is used to pay interest on that money. At 13%, interest is responsible for ⅔ of the total cost.

Today, in 2015, renewable energy projects have to compete for financing with fossil fuel projects, mining projects, road construction projects, corporate debt and government debt to name a few. What if there was a special kind of loan, only available to renewable energy projects, and these special loans were zero interest and had 20+ year terms? If we had a way to fund renewable energy projects on a massive scale with funds like this it would be a total game changer. Because of the zero interest rate, the cost of renewable energy produced would drop by up to 50% without any reduction in the actual cost of the solar panels or wind turbines being installed.

But how could huge, multimillion dollar, zero interest (thus below inflation) loans be made? No one would invest in such a money losing proposition, would they? This is where the retirement model strategy of putting aside 10% of current fossil energy expense comes in.

4 Introducing the National Renewable Energy Fund (NREF)

What we need is a pension fund for fossil fuels. Such a fund would collect contributions based on fossil fuel consumption and invest that money in renewable energy, slowly building the renewable energy base until fossil fuels are hardly needed anymore. To understand how the seemingly impossible becomes possible, let me introduce you to the core piece of this plan: The National Renewable Energy Fund.

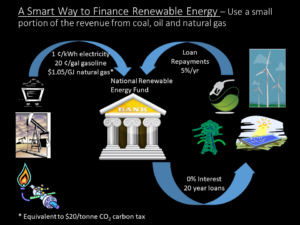

The National Renewable Energy Fund (NREF) is envisioned to be a financial entity whose sole purpose is to provide very low interest, long-term loans for renewable energy projects. Very low interest means 0%, long-term means 20 + years. The NREF is able to offer these unheard-of-terms and still stay solvent because of its unusual source of lending capital – a levy on fossil CO2. Fossil CO2 levies collected from fossil fuel providers within a country are transferred to the NREF and loaned out to renewable energy projects within that country. As such, the NREF provides a strong, direct financial connection and linkage between the fossil fuel use of a given nation and funding available for renewable energy projects within that same nation. What this means in practice is that the higher the fossil CO2 emissions, the higher the funding for fossil carbon free energy production.

The size of the levy determines how fast we transition from fossil fuels to renewable energy. A high levy will get us there faster, but will result in more backlash as energy costs increase. Too low a levy and we won’t make transition fast enough. If our goal is to reduce fossil CO2 emissions 80% by mid century, then a levy of about $20 USD per tonne of fossil CO2 is about right. Note this is a fixed rate. It only needs to rise to match inflation. This may seem surprising to those who have studied carbon taxes, but it is true.

This $20 per tonne fossil CO2 levy is equivalent to, on average, 1.5 cents per kWh of fossil fuel generated electricity (about 2 cents for coal power and 1 cent for natural gas power), about 20 cents per gallon of gasoline and $1 per GJ of natural gas. If the entire world implemented this levy it would work out about 12% of the total amount spent on fossil energy annually.

Figure 1 – Money flows for National Renewable Energy Fund

The name “National Renewable Energy Fund” was chosen carefully. “National” – this is a national body working within a specific country and for that country’s benefit by using a levy collected in that county from fossil carbon usage within country. “Renewable Energy” – the fund focuses on developing renewable energy, energy that is inexhaustible, clean, and minimally disruptive to the environment. “Fund” – the NREF provides funding loans for new projects or initiatives, not ongoing subsidies.

While the exact structure of the NREF would likely vary from country-to-country, generally it would be part of the government but operated as an independent financial entity at arm’s length under its own mandate to reduce fossil CO2 emissions through funding renewable energy projects. To imagine how this could work, looking at the governance model used by the Canada Pension Plan Investment Board (CPPIB) is informative. The CPPIB was established in 1997 to manage Canada’s national pension plan assets and has proven to be very successful. The CPPIB model is the basis for the NREF described herein. The following three paragraph’s structure was borrowed from the CPPIB’s governance overview to demonstrate the kind of governance envisioned for the NREF and its mission to reduce fossil CO2 emissions.

The NREF’s overarching purpose is to assist the government in meeting its obligations to drastically reduce fossil carbon emissions by 2060. To enable this, governments need to create a governance model that allows the NREF to operate as a professional investment organization with a commercial, investment-only mandate.

The assets the NREF manages belong to the citizens of the country it operates in. These assets are strictly segregated from government funds. The legislation creating the NREF must have safeguards against any political interference. The NREF operates at arm’s length from the government with the oversight of an independent, highly qualified professional board of directors.

The legislation holds the Board of Directors and management accountable for their performance under a rigorous public accountability regime which includes accountability to the Finance Ministers who serve as the stewards of the NREF.

The NREF will receive its lending capital from the government through levies on fossil fuels and it is important that legislation be in place to ensure the government does not take the levy for its own use. This is critical in gaining acceptance for the plan, and allowing the NREF to achieve the goal of 80% to 90% reduction of fossil fuels by 2060.

The NREF will have no creditors and no depositors. All lending capital is acquired through a levy on fossil fuel consumption. The NREF is owned by the government (i.e. the people), but operates at arm’s length. It is non-profit, and ideally the fund’s leaders would be compensated based on the reduction in carbon emissions achieved within the country.

4.1 How the NREF can get us off fossil fuels by mid-century

It is intuitive that providing zero interest, long term, loans will result in low cost renewable energy and such renewable energy can displace fossil fuel energy with the correct policies in place leading to reduced fossil CO2 emissions. However questions remain about how fast emissions can be reduced and how low can they go.

To answer that question, a spreadsheet model was built to project the effect of having the NREF use the revenue from a $20/tonne CO2 fossil carbon levy to fund renewable energy projects with 0% interest, 20 year loans with the goal to reduce fossil CO2 emissions by 80% from the starting year.

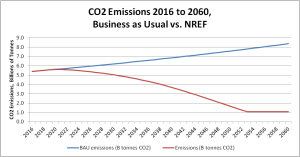

Presented below are the results of running the model using emission and other data from the United States. The US emitted 5.4 Billion tonnes of fossil CO2 in 2013. It is assumed emissions for Business as Usual (BAU), that is, emissions if the US did not enact the Not Impossible Plan, would grow at 1%/year. This is a pessimistic estimate given over the past 10 years CO2 emissions from the US have dropped.

Other details/assumptions of note include that during program startup the fossil CO2 levy ramps up from $5/tonne to $20/tonne over 3 years, inflation is assumed to be 2%/year, the model assumes the CO2 reduction from a renewable energy project occurs 2 years after the loan was made, the cost of running the NREF is assumed to be 1% of the annual loans placed plus 0.1% of loans outstanding, the loan default rate is assumed to be 1% of the outstanding loans with a 70% recovery rate and finally it is assumed the capital cost of renewable energy falls over time at 2%/year.

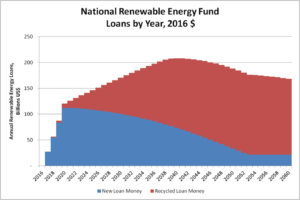

The results of the model using data from the US are shown graphically in Figures 2 and 3. In figure 2, the projected NREF loan amounts from 2017 to 2060 are shown. The total amount of the loans in any given year are shown in two parts; in blue is the new money collected via the $20/tonne carbon levy and in red is the money repaid from prior loans. Of course at the beginning almost all the loan money is coming from the carbon levy, but over time the repaid money becomes the majority source of loan money. The chart is in constant 2016 dollars.

Figure 2 Funding available per year using the NREF in USA

We can see the money available for loans from the carbon levy falls over time due to falling fossil fuel use while the total loans made every year continue to increase due to more loans outstanding and being paid off. The peak loan year occurs around when the first loans are fully paid off in 20 years after the first loan.

What is expected to happen to fossil CO2 emissions for the USA is shown in Figure 3.

Figure 3 Modeled fossil CO2 emissions estimates for USA

The Business as Usual line is an assumption that no action is taken and emissions grow at 1% per year. The Emissions line is the forecast given the renewable energy projects made possible by the NREF displace the traditional fossil energy. We see emissions continue to rise for about 5 years and then the curve bends downward and hits 80% reduction in 2053.

This is a simplified model that uses a blended price of renewable energy that combines wind, solar, geothermal, some nuclear displacing a bend of fossil sources include coal, natural gas and oil. A more detailed model that breaks out all those effects is available, but overall results are similar to what is shown here.

Using the spreadsheet model, other countries and the world as a whole have been analyzed to find out the potential effect of using the Not Impossible Plan and the NREF to retire fossil fuels. In every case the results look very promising as an effective method for massive reductions in fossil fuel use and thus preventing runaway climate change.

4.2 The NREF in Operation

The main tasks of the NREF are to solicit open bidding for renewable energy projects in need of funding, to vet and rank those projects, to provide loans for the best projects, to work with loan recipients to help their projects succeed and, at the same time, to ensure the loan money is being spent prudently and within the terms of the loan through regular audits. Furthermore, the NREF will provide annual reports to the government and citizens regarding its financial condition, what all money has been used for each year and as to the performance of projects funded in the past. Transparency and competency are critical to the NREF’s reputation and success as the NREF must be deemed worthy of trust.

Website and information sent out to all citizens about progress to date and near term plans would help keep people engaged and aware of the work being undertaken and the fossil CO2 reduction progress. Projects receiving funding should be required to display prominently, both at the project site and on any informational material, be it online or in print, that they are an NREF funded project.

The NREF would be funded exclusively from a levy on fossil fuels. No other funding from government or other sources would be needed. Funding would work as follows.

The government collects a levy from companies producing or importing fossil fuels on all fossil fuels that enter the country, be they extracted within the country or imported, at a rate commensurate with the amount of CO2 the fossil fuel will release when burned. If the fossil fuel is exported (i.e. not used within the country), or the resulting CO2 is sequestered for long term storage, the levy is refunded.

Of the total levy collected, up to 15% could be used to offset the extra costs of fossil energy imposed on low income families by the fossil CO2 levy. A further 3% could be used to offset hardship caused to families during the shift from fossil fuels to renewable sources (ex. coal miners and their families.) These funds could be used for training programs, relocation money, even direct buyouts to help those most affected by the transition. The balance of funds, 82% of the total, would be transferred to the NREF for loans.

It is important to note that the NREF loans serve two purposes. First, they ensure that the level of investment required to get us off fossil fuels will occur year-after-year, regardless of changing economic conditions, political change, etc. Second, they ensure that the renewable energy produced is at as low a cost as practically possible. Those two outcomes will serve the nations with a NREF well, both now and in the future.

The types of projects that would be suitable for funding are wide, but the criteria for project selection must require projects to either produce renewable energy capable of displacing fossil fuel energy, for example

• Onshore wind turbines,

• Offshore wind turbines

• Photovoltaic (PV) solar,

• Thermal solar,

• Geothermal,

or to support the utilization of renewable energy, for example

• Transmission lines,

• Energy storage systems.

• Synthetic fuel production systems

In addition, projects must be able to pay back the loans. These are not grants. This is important for 3 primary reasons. First, having to pay back the loans will weed out boondoggle projects that look nice but never will produce economically-viable power. An example of such a project would be the current generation of wave energy machines. Second, paying the money back allows that same money to be loaned out again in the future. Overtime this becomes hugely important because financial models show that in 2040, 75% of all the money being loaned out will come from previous loan repayments because decreases in fossil carbon emissions will result in less new money coming in from the fossil fuel levy. Without recycling of the funds there is no way to reach the reduction required by 2060 without a much higher levy. Finally, it is better politically, as the fund is owned by the people. Having the money paid back in full gives people more confidence the money is not being wasted. Once we are off fossil fuels, the money could be repaid back to the people though a special dividend, or the fund to continue to fund renewable energy projects thus continuing to ensure the lowest cost energy possible or provide funds to pay for negative CO2 technology deployment which the latest climate models say will be needed in the latter part of the century.

There should not be any restriction on the type of company applying for the loans. Even oil companies would be welcome if their projects will produce renewable energy. Loans are about the projects, not the types of company.

While the exact process of picking projects will vary from country-to-country, in general the following guidelines should apply.

1. Loans are only for projects that produce renewable energy. While it would be tempting to use the money support energy efficiency projects and support research of new technologies, it is important to resist this temptation. Not to say efficiency isn’t important, but it is better handled through other policies as explained later.

2. Loan terms are 0% interest for 20 years, or the expected useful life of the project, whichever is less. Projects would be expected to have equity funding from other, traditional sources, at least 20%. It is important that project developers be expected to have some skin in the game.

3. The selection process needs to be open and transparent. Because there is a lot of money in play, the risk of corruption is very real. If loans appear to being given out unfairly or to be wasted, public support will quickly evaporate. Therefore the criteria for project selection should be very clear and spelled out. Criteria might entail energy cost, company’s ability to perform, track record, time to market, etc.

4. Guidelines must be created as to how the loans are distributed geographically. This will be a challenge. Ideally for fossil carbon reduction all the loans would flow to where natural conditions are best and renewable energy per unit of loan is highest. However due to the hardship to fossil fuel workers and local governments as we shift away from those fuels and the high economic impact of the loans will have on local economies, this may not always be the practical. For example in Canada, oil sands dependant Alberta will be the most impacted part of the country as fossil fuels are retired and will also be paying the highest share of the fossil carbon levy, so it would be expedient to see Alberta receive a higher percentage of the loans available for renewable energy development. In this particular case this isn’t hard as Alberta happens to have some of the best solar and wind resources in Canada.

5. There also need to be guidelines as to ratios loaned to different types of projects. In particular some money, perhaps 5% to 10%, needs to be reserved for local, small scale projects. Even though these projects may not be as cost effective as larger ones, they are important for gaining and keeping public support. Of course, these loans still need to be paid back.

6. The NREF needs to strive to loan out all the money it receives every year – 100%. Its goal is to develop the most renewable energy possible and hoarding cash waiting for only the lowest risk projects will run counter to this goal.

Once the loans are made, monitoring the energy projects’ progress and performance is critical. All projects would be audited at least once per year for the life of the loan. During construction, monies would only be released as the project met milestones. The loans would include terms that state that if the project does not produce the energy predicted within a reasonable time-frame, the loan will be called and the project put in bankruptcy. The NREF would have the right to seize nonperforming projects and sell them to a new operator. The public needs to be made aware that some failures are expected and normal along with how such cases will be handled. Note that no depositors or bond holders are at risk because there are no depositors or bond holders.

4.3 Other Supporting Policies Required

While the NREF provides a firm foundation and does most of the heavy lifting to retire fossil fuels, there are other complementary policies required to support the NREF’s success. If it is followed, the NREF pretty much guarantees that enough renewable energy systems will be built to get us off fossil fuels and that the renewable energy produced will be the lowest cost possible. However, while the energy may be lower cost than fossil energy, there is no guarantee. The cost of digging fossil based energy out of the ground is shockingly low. For example, in Saudi Arabia the marginal cost of producing a barrel of oil is about $5. Without a policy to ensure that renewable energy is used before fossil energy, renewable energy providers may struggle to find a market for the energy they produce.

With a classic carbon tax, part of the hypothesis for success relies on making fossil energy more expensive than renewable energy. The tax required to make that happen is very high, with estimates ranging from $100 to $300 or more per tonne CO2 ($1 to $3 or more per gallon of gasoline.) Even at these tax rates there is no guarantee renewables will win the price war. One of the main advantages of the Not Impossible Plan is it keeps the fossil carbon tax low so energy costs don’t rise too much. Thus we need a policy that ensures renewable energy stays at the front-of-the-line when it comes to usage. Without such a policy fossil fuel producers could simply keep the price of fossil fuel below renewables, and all the renewable energy built with NREF funds won’t be able to find a buyer.

A second set of policies need to address continual improvement in efficiency. Again because the Not Impossible Plan leads to lower energy prices, the big stick to improve efficiency isn’t built in.

There already a set of policies in many jurisdictions in use now that accomplish these tasks and could easily be extended for use as part of the Not Impossible Plan.

4.3.1 Mandate minimum percentage of low fossil carbon energy

There are policies that are in use today that set a minimum amount of renewable energy in the energy supply. These policies are generally known as Renewable Portfolio Standard (RPS) in the electricity market and Low Carbon Fuel Standards (LCFS) in the liquid and gas fuel markets. Other names include Renewable Electricity Standard (RES) at the United States federal level and Renewables Obligation in the UK for electrical power, and Renewable Transport Fuel Obligation and Renewable Fuel Standard for fuels.

Put simply, such legislation states that a certain percentage of an energy type must come from low fossil carbon or renewable sources. For example, in California’s RPS, 33% of the electricity used must come from certified renewable sources by 2020. Companies that supply electricity to industry or consumers must enter into long-term power agreements with renewable energy suppliers to ensure that they can meet the 33% renewable target. This provides a ready market for green electricity, but not an unlimited market. The renewable energy suppliers need to bid in a competitive marketplace to provide the power, thus costs are kept down. The percentage of renewable energy required is expected to grow over time, eventually getting to 80%+.

The same could be done with liquid hydrocarbon fuels, and natural gas. Many jurisdictions, including BC, have a renewable fuel standard. Today these standards are targeting Bio-Ethanol being blended into gasoline, and Bio-Diesel being blended into Diesel fuel. These two tend to have low maximum blending amounts possible (about 10%) as they are not exact chemical replacements for the fuel they are blended with. In the future, when renewable drop-in fuel replacements are widely available (funded by the NREF) mandated blending can rise to even 100% as the supply of renewable fuels grows. This would happen slowly over decades. With the goal to get to 80% renewable by 2060, we could start at the current 10% requirement and add 2% per year starting in 2025. Of course this would requirement would be matched by investments from the NREF to build the renewable energy systems to supply the low carbon fuel required to meet the mandate.

Similarly, with natural gas, Renewable Natural Gas (RNG) can be blended with fossil natural gas in any percentage as it is a drop-in replacement, chemically identical to fossil natural gas. Both are mainly methane, with a few trace gases. While RNG from landfill gas and bio-gas from compost systems and animal waste is now being introduced into Natural gas distribution systems, including BC, the maximum amount of RNG available from these sources is quite limited. To get blending at levels above 10%, technologies for synthesizing methane from renewable energy, water and CO2 will be necessary.

Rule-makers would need to work together with the NREF planners to ensure there is a market for all the renewable energy coming online, and that the type of projects funded fit into the country’s overall energy picture.

4.3.2 Efficiency Standards

Another set of policies needed to support the success of the NREF are efficiency standards. While it is technically possible to get off fossil fuels without improving efficiency, having sensible efficiency standards can lower the total amount of energy required to supply our needs, thus makes the job of building the renewable energy systems to supply those needs that much easier and less expensive.

We need continuous improvement in efficiency standards for cars and trucks, home appliances, airplanes, buildings and many other products that use energy to minimize waste. However the goal is not efficiency at any cost. Any costs for improvements in efficiency must be balanced against savings in energy usage.

Under the Not Impossible Plan energy stays relatively cheap, so high cost energy cannot be counted on to persuade consumers and businesses to purchase efficient options. The efficiency policies needed would likely be simply extensions of policies already in place in most places in the world for new products and buildings, such as the Corporate Average Fuel Economy (CAFE) standard for cars and Leadership in Energy and Environmental Design (LEED) for buildings, as well as the Energy Star program for appliances.

4.3.3 Policies not needed

It is worth noting that with the NREF operating, there are a plethora of special subsidies paid for out of general tax revenue in use today to encourage renewable energy use that would no longer be necessary, thus saving the government money. For example tax credits such as production tax credits, accelerated capital cost allowance credits and purchase tax credits would not be needed. Tax credits for electric cars would not be needed. Neither would government backed loan guarantees or direct subsidies. Government grants for R&D would not need to expand as the market forces created by having a guaranteed worldwide market of $500B rising to $1T (the annual renewable energy investment if all countries in the world used the plan) for renewable energy equipment would spur private R&D to a level never seen before in renewable energy.

4.4 NREF Advantages

Here is a list of some of the advantages of the Not Impossible Plan using the NREF as compared to a revenue neutral carbon tax or a tax and dividend carbon tax schemes.

1. By far the most important advantage of the Not Impossible Plan is the much lower tax rate required to achieve large reductions in fossil carbon emissions. It is expected that a fossil CO2 levy of $20/tonne in 2016 dollars is all that is required to retire almost all fossil fuel use by between 2050 and 2060. The $20 levy doesn’t need to rise over time (other than to match inflation.) So that’s it, $20/tonne forever. Other tax schemes often start at $20/tonne but must invariably call for increasing the tax over time, typically $10/tonne per year until the reductions in emissions are achieved. Estimates for the level of tax required to meet emissions reduction target when not following the Not Impossible Plan vary, but typically are estimated at $100 to $200/tonne, 5 to 10 times higher. As stated earlier, these high taxes are required because they must force the price of fossil fuel energy above that of renewables to work.

The much lower tax in the Not Impossible Plan has a number of advantages, both psychologically and economically. First, the tax is more palpable to voters as the impact at the gas pump is much, much less (20¢ a gallon versus $1 to $2 a gallon.) Second, the attraction to cheat is much less. Smuggling of untaxed fossil fuels into a country with a high tax is much more likely. A tanker with 100,000 barrels of untaxed oil at $200/tonne fossil CO2 tax is worth $10M more if it can be slipped into the country without paying the tax. Extreme taxes can lead to extreme cheating. Third, the low amount of tax is easily absorbed into an economy. An extra 20 cents a gallon for gasoline has no chance of torpedoing an economy as those kinds of price changes happen every month nowadays. Last, the tax is low enough that the economic advantage afforded to a country that chooses not to implement the NREF model is not very great so it is possible for countries to “go it alone”, like British Columbia did with its $30/tonne carbon tax in 2008.

2. The Not Impossible Plan offers a direct connection between the fossil CO2 levy being collected and the increase in non-fossil carbon renewable energy produced. What this means is that the higher the CO2 emissions are, the more money becomes available to pump into renewable energy thus cutting those emissions, a closed loop. This feature is very important, as it provides an absolute guarantee that emissions will fall, and fall dramatically over time, if the plan is followed. This link connecting fossil CO2 emissions directly to increases in renewable energy does not exist in other fossil CO2 reduction policies.

3. The plan allows people to see with their own eyes the results of the fossil CO2 levy. All projects will have conspicuous signage stating “This project was financed by the National Renewable Energy Fund.”

4. A traditional carbon tax’s aim is to make fossil energy more expensive but does nothing to lower the cost of renewable energy. The NREF makes renewable energy less expensive in absolute terms through zero interest rate loans, even when the capital outlays are the same.

5. With the plan no other tax breaks are required to incent renewable energy projects, thus the burden on normal government funding is lower.

6. The Not Impossible Plan is a relatively simple policy to understand and implement.

7. Provisions for rebates for lower income families and for money to directly benefit any workers meaningfully affected by the transition from fossil fuels can be built into the plan. This would help remove roadblocks that have traditionally been used to argue against a carbon tax, namely that it is hard on the poor and workers in the fossil fuel industry.

8. The plan can be applied in any country, under any form of government.

9. The Not Impossible Plan provides guaranteed results toward making enough renewable, fossil-carbon-free, energy available to allow the reduction in fossil fuels required to stop run away climate change. This is a result of the direct linkage between fossil CO2 emissions and renewable energy construction explained earlier. This linkage is so strong that the only question about the estimates regarding the plan’s performance contained herein are related to the date a given reduction in fossil CO2 emissions will be achieved, not if they will be achieved. For example, if my estimates for the capital cost of renewable energy were wildly off, and the true capital cost turns out to be 50% higher than estimated, the goal of 80% reduction in fossil CO2 emissions will still be met, but it would happen 8 years later than originally forecast.

4.5 A sample year – 2014

To demonstrate how this would work in detail, let us consider what would have happened in the US in 2014 if there was a NREF with a $20/tonne levy in place. Here is what it would have looked like.

| Type of Fossil fuel | US Consumption 2014 | CO2 emissions from fuel | Net Levy @ $20/tonne CO2 |

| Coal | 916.7 M short tons | 1707 M Tonnes | $17.1B |

| Oil | 19.03 M Barrels/day | 2987 M Tonnes | $29.9B |

| Natural gas | 26.82 T cubic ft | 1422 M Tonnes | $14.2B |

| Total | 6116 M Tonnes | $122.3B |

Table 1

Sources

http://www.eia.gov/totalenergy/data/annual/index.cfm#petroleum

http://www.epa.gov/cleanenergy/energy-resources/refs.html

As you can see from the table, had the NREF been in place, $122B in levies would have been collected. This is about 0.6% of GDP, and it gets put right back into the economy.

Of the $122B collected, $18B could have been distributed to households whose income is in the lower 50% of families, or about $300 for each family with an income under $52,000 per year. This amount would more than cover a typical lower income family’s extra direct expense due to the fossil CO2 levy.

A further $3.7B could have been used to help displaced workers. There are currently about 600,000 oil and gas workers and 80,000 coal workers in the US. If there is a steady decrease in employment in these sectors over 35 years, due to the switch away from fossil fuels, this money could provide $150,000 per worker for training, relocation and other assistance.

The $100B balance remaining would be transferred to the NREF to loan for renewable energy projects. This equates to three times the amount invested in US based renewable energy projects during 2014 without the NREF.

5 What Could Have Been

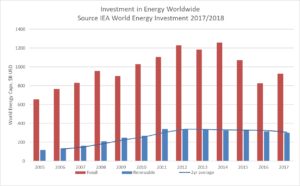

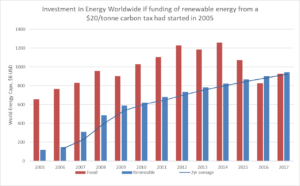

As noted earlier, investment in renewable energy worldwide has flatlined since 2011. Figure 4 shows data from the International Energy Agency’s report on World Energy Investment from 2005 to 2017. After a peak in 2011, investment in renewable energy has stayed generally flat, and slightly down after 2015, the year the Paris Agreement was agreed to.

Figure 4

Perhaps even more concerning is the rate investment in fossil fuel energy is still three times the that of renewables. This is not the shape of energy investments to get to a low fossil carbon future and address Climate Change in time.

To see what could have been, I modeled what renewable energy investments could have been if the world had instituted the Not Impossible Plan stating in 2005. A levy on all fossil fuel started at $5/tonne fossil CO2 and went up $5/year until is reached $20, inflation adjusted back to 2008. I assumed all renewable energy was financed through NREFs. Figure 5 shows the result.

Figure 5

The graph shows what we would hope, renewable energy investments rising steadily, starting to exceed fossil energy investments in 2016 and 2017 and over three times higher than the investments that actually occurred. All this for only $20/tonne levy on fossil CO2, but smartly applied to renewable energy projects.

With that said, it is not too late. If we start to take a portion of what we spend every year on fossil fuels and direct it toward low interest loans for renewable energy projects, our energy system can be essentially fossil fuel free by 2060.

6 Conclusion

We can see from the advantages listed, and from the projections showing it is possible to reduce our fossil fuel consumption by over 80% within the time frame scientists say is required to mitigate the worst effects of climate change, while continuing to enjoy a energy rich life, the Not Impossible Plan is a plan worth considering.

To learn more about the Not Impossible Plan, visit http://www.notimpossibleplan.org

7 About the Author

Don holds a Masters of Engineering in Clean Energy Engineering and a BASc in Electrical Engineering from the University of British Columbia. He has an unusually broad knowledge of renewable energy systems, business, electronic/mechanical design, and software design along with a deep understanding of thermodynamics, chemistry and statistics. In 2009 Don left a successful 25-year career as a high technology executive to focus his efforts on helping prevent further climate change. Don returned to university in 2010 and obtained his M.Eng. in Clean Energy Engineering. Since that time he has been working in the clean technology sector in Vancouver, Canada, while developing the ideas behind The Not Impossible Plan. He has presented on the subject of Climate Change and solutions to groups throughout British Columbia, as well as audiences in Washington and Oregon.

Don resides in Nanaimo BC, Canada, with his wife. Don can be reached at dgayton@notimpossibleplan.org